- Adding payments

- Creating credit invoices

- Exporting Accounting and Checking for Errors

- Exporting IPAFFS

- Exporting statistics overview (CBS and IDEV)

- Invoicing

- Making a copy of administration

- Modifying an existing RMA

- Offsetting Invoices

- Reversing payments / Making an invoice unpaid

- SEPA: What do the error codes mean?

- Setting up UBL

Setting up UBL

In this guide you will learn how to configure the settings for payment options, tax regulations and endpoint IDs for both suppliers and customers. These settings are essential for integration with financial systems, such as IBAN/BIC codes, VAT codes and company identifications (Chamber of Commerce/OIN codes).

Note: Since 01-01-2025, sending invoices digitally is mandatory in some EU countries. The standard used for this, XRechnung 3.0, can be set up via the steps below. Steps to configure the settings:

- Open the Invoices tile

- Start the configuration by navigating to the Invoices tile.

- Navigate to (Other) UBL Configuration

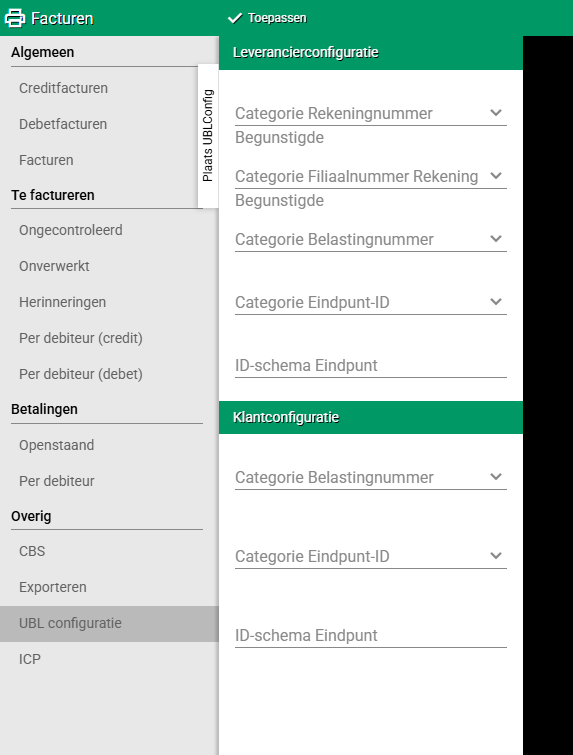

- Go to the Other menu and select the UBL configuration option. The following screen then opens:

Configuring settings:

Step 1: Configuring Supplier Payment Options

These settings determine how the supplier's payment accounts are identified.

Beneficiary account number category supplier

Purpose: Determines the category for the supplier's financial account ID, such as an IBAN number. Example Category: IBAN (International Bank Account Number).

Beneficiary account branch number category supplier

Purpose: Determines the category for the supplier's branch number, for example BIC (Bank Identifier Code).

Example Category: BIC.

Step 2: Configuring Supplier Tax Regulation

These settings determine how the tax regulation and VAT-related identification of the supplier are tracked.

Tax number category supplier

Purpose: Defines the category for the supplier's tax regulation identifier, such as the VAT number.

Example Category: VAT Number (Value Added Tax identifier).

Step 3: Configuring Supplier Endpoint ID

These settings define the supplier's endpoint IDs used for system integration.

Endpoint ID category supplier

Purpose: Determines the category in which the supplier's endpoint ID number (Chamber of Commerce or OIN code) is stored.

Example Category: Chamber of Commerce or OIN code (Company identification number).

Endpoint ID schema supplier

Purpose: Specifies the schema ID for the supplier's endpoint, linked to a company identification system (for example Chamber of Commerce for Dutch companies or OIN for other systems).

Example: Chamber of Commerce: schema ID 0106, OIN: schema ID 0190.

Step 4: Configuring Customer Tax Regulation

These settings determine how the tax regulation and VAT-related identification of the customer are registered.

Tax number category customer

Purpose: Defines the category for the customer's tax regulation identifier, such as the VAT number.

Example Category: VAT Number (Value Added Tax identifier).

Step 5: Configuring Customer Endpoint ID

These settings determine how the customer's endpoint IDs are used for integration with external systems.

Endpoint ID category customer

Purpose: Determine the category in which the customer's endpoint ID number (Chamber of Commerce or OIN code) is stored.

Example Category: Chamber of Commerce or OIN code (Company identification number).

Endpoint ID schema customer

Purpose: Specifies the schema ID for the customer's endpoint, linked to a company identification system (such as Chamber of Commerce for Dutch companies or OIN for other systems).

Example: Chamber of Commerce: schema ID 0106, OIN: schema ID 0190.

Step 6: Saving the Settings

Click Apply to save the settings.

With these steps you have correctly configured the payment options, tax regulations and endpoint IDs of both suppliers and customers. This ensures that your system is ready for integration with external financial systems and complies with the requirements for digital invoicing within the EU.

IMPORTANT: Supported Standards X Rechnung 3.0 is currently the supported standard within Easyflor for digital invoicing. This list may be expanded in the future, depending on new standards for other countries.

Heeft u vragen of heeft u hulp nodig? Neem dan gerust contact met ons op via telefoonnummer +31 (0)71 30 20 310 of stuur een e-mail naar support@easyflor.nl.